Liability

Bespoke liability risk assessment advice and training to protect people and performance

Liability Risk Management

Liability risk is a concern for every organisation. It's essential to manage liability risk by adopting and using appropriate risk management frameworks and processes. With clear visibility over the risk landscape and smart management of your risk profile, you can make better decisions and protect people and your reputation.

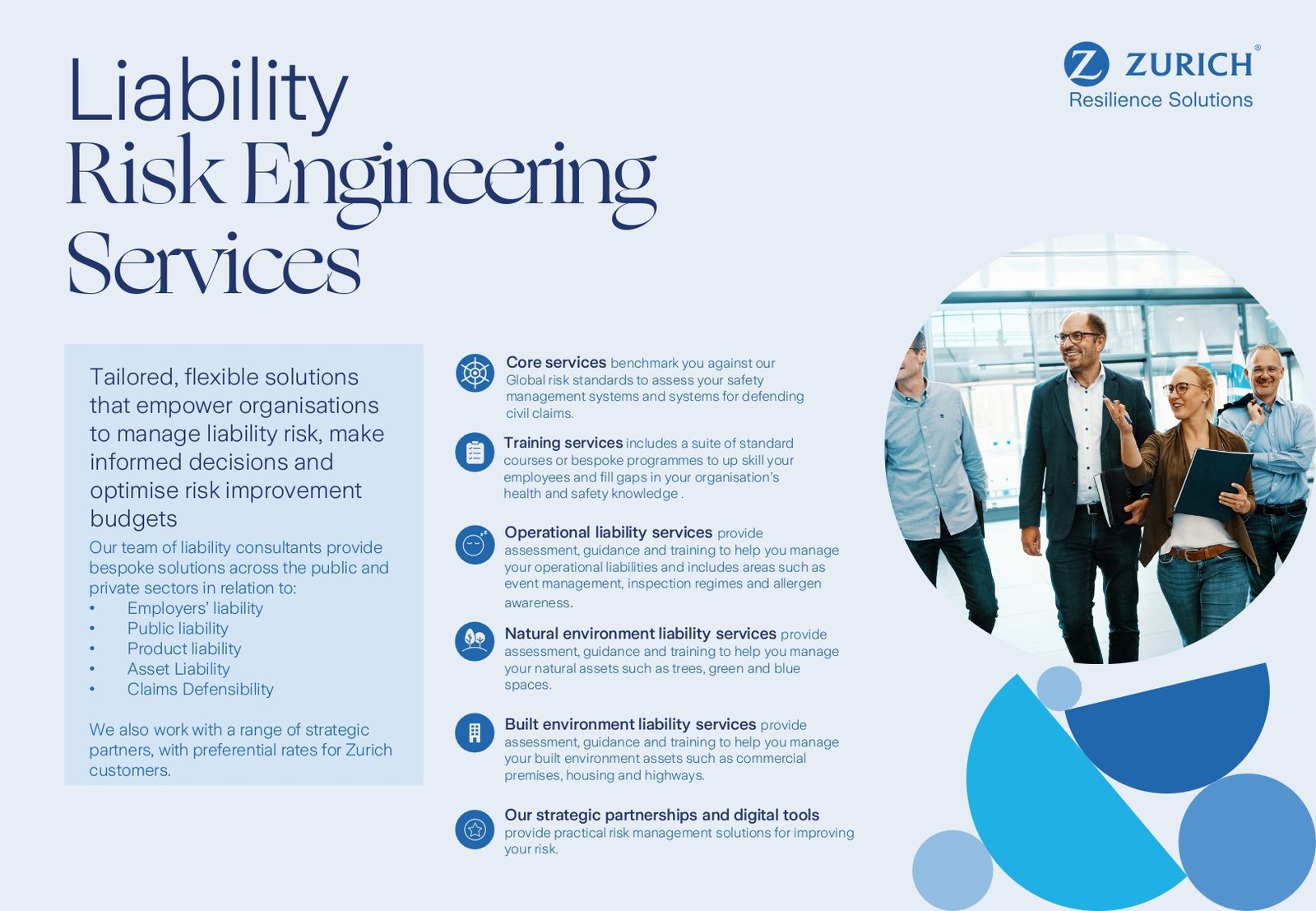

At Zurich Resilience Solutions (ZRS), we provide tailored risk management services. We empower organisations to make informed decisions, optimise budgets, and manage risk on several fronts. Whatever your organisation’s size or sector we can work with you to reduce risk.

From safety management training to consultacy and advice, we deliver bespoke services based on your current needs and future goals.

We can help you with employers' liability, public liability, product liability, claims defensibility and more. Our services are designed to align with your budget and long-term vision. Our experienced team of health and safety and liability consultants does more than deliver services — they unlock targeted solutions to help you operate with greater confidence.

We protect your people, assets and reputation by reducing risk and improving claims defensibility should the worst happen.

Review and Manage Liability Risk

At ZRS, we help you identify, manage and overcome liability risk. We will review your risk identification profile, shed light on your current exposures, and help you to reduce and manage risk on several fronts. Whether you're setting up new systems, entering new territory, or trying to prevent and defend claims, risk management is core.

Extensive Liability Risk Solutions

Our experienced team can perform a detailed assessment of liability risk across your organisation. We can analyse your risk profile in several key areas, from people and products to buildings and assets. We can review how you investigate accidents and defend claims, and also show you how to build stronger systems and optimise risk management budgets.

From potential accidents to past losses, from employees and customers to the built environment, our extensive risk analysis and improvement measures are designed to help you thrive.

Supporting downloads

Sign up for our Newsletter Today

Keep up to date on the latest risk management topics and industry insights.

Frequently Asked Questions

Organisations can reduce liability risk through several strategies, including:

- Implementing Comprehensive Policies: Establish clear guidelines and procedures that outline expected behaviours and processes to mitigate risks.

- Regular Training and Education: Provide ongoing training for employees on safety protocols, compliance, and risk awareness to minimise the likelihood of incidents.

- Conducting Risk Assessments: Regularly evaluate potential liabilities associated with your operations and address any identified risks promptly.

- Utilising Contracts Wisely: Carefully draft contracts to limit liability exposure and clarify responsibilities with clients, suppliers, and partners.

- Purchasing Insurance: Obtain appropriate liability insurance coverage to protect against potential claims and financial losses.

A liability management strategy typically includes:

- Risk Identification: Recognising potential areas where liability may arise.

- Risk Assessment: Evaluating the severity and likelihood of identified risks.

- Implementation of Controls: Establishing measures to manage and mitigate risks, such as policies, procedures, and training.

- Monitoring and Review: Continuously tracking the effectiveness of the strategy and making adjustments as needed in light of new risks or events.

- Crisis Management Planning: Preparing for potential incidents by having a response plan in place.

Liability risk management is crucial for organisations because it:

- Protects Financial Stability: Effective management helps avoid costly legal claims and settlements that can impact the organisation's financial health.

- Enhances Reputation: By demonstrating a commitment to safety and compliance, organisations can build trust with people, customers, partners, and the community.

- Ensures Compliance: Proactive risk management helps organisations comply with regulations and reduce the risk of fines and penalties.

- Promotes Operational Efficiency: Identifying and mitigating risks can lead to improved processes and a safer work environment.

The key components of a liability management plan include:

- Risk Assessment Framework: A systematic approach to identifying and evaluating risks.

- Policies and Procedures: Clearly defined guidelines for managing liability and ensuring compliance.

- Training Programmes: Initiatives to educate employees on risk management and safety practices.

- Insurance Coverage: Appropriate liability insurance policies to mitigate financial exposure.

- Monitoring and Reporting Mechanisms: Systems for tracking incidents, claims, and the overall effectiveness of the management plan.